Base Erosion and Profit Shifting (BEPS) or, … a global “ Fiscal Big Brother” ?

August 2020

During the meeting of Finance Ministers of the G20 Member States, held in July 2013, the Organization for Economic Cooperation and Development – OECD presented the “Base Erosion and Profit Shifting Action Plan” (BEPS Action Plan), with the objective of combating the erosion of the tax base and the diversion of profits to low tax jurisdictions.

In this sense, the BEPS Action Plan intends to mark the end of an era of “laissez-faire” and marks a new era of intervention by States, translating, concretely, in raising the standard of “best practices” to be implemented, in tax plan, by companies within the scope of their activities.

In this context, and given the relevance of the BEPS Action Plan in operations not only in international groups (although these are the main targets) but also with “collateral damage” in most companies, Vitis will be aware of the practical implications and the need for implementation of procedures that respond to these requirements.

Although the BEPS reports are mere recommendations, there are currently practical implications for changes in legislation by States, with the adoption of part of the recommendations already issued, and it is expected that national tax systems will increasingly adopt additional measures, which is why which economic agents should effectively monitor, effectively, the impacts resulting from BEPS at the level of their operations and the way they are structured.

Some of these recommendations, when adopted by the EU with the approval in January 2016 of an anti-avoidance package and the consequent publication of regulations and Directives, become mandatory for Member Countries. In particular we refer to ATAD – Anti Tax Avoidance Directives.

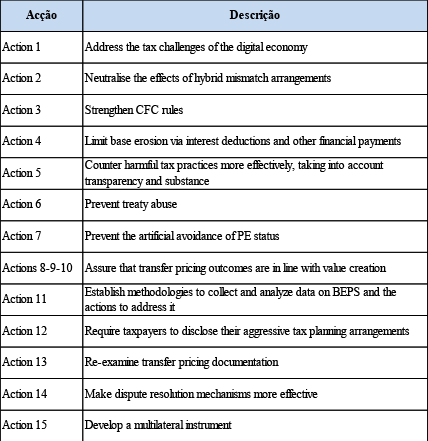

The recommended actions under the BEPS are as follows:

Some of these recommendations have already been introduced into Portuguese domestic law through the transposition of the ATAD Directives approved in the meantime.

We can thus summarize them:

1-Hybrid asymmetries

Law 24/2020 of 6/7 partially transposed Directive (EU) 2016/1164 as amended by Directive (EU) 2017/952 – regulating hybrid asymmetries with third countries, adding in particular to the CIRC the articles 68º-A to 68º-D with application to tax periods beginning on or after 1 January 2020 and, with regard to reverse hybrid asymmetries, beginning on 1 January 2022.

The inverse hybrid asymmetries refer to situations in which non-resident hybrid Entities are considered to be residents for tax purposes in Portugal, and are taxed here provided they have more than 50% interests in Entities resident in Portugal.

A hybrid entity is any entity or mechanism that is considered to be taxable under one jurisdiction and whose income or expense is treated as the income or expense of another person under another jurisdiction.

This theme is part of BEPS Action 2 – Neutralize the effects of hybrid mismatch arrangements, with a view to identifying the best approach to neutralize the fiscal impact resulting from the use of artificial profit diversion mechanisms.

The main mechanisms based on the hybrid element used (ie, financial instrument, income stream or entity), with implications of the tax treatment of the respective payments, materializing by double deduction (ie, in the sphere of the paying and beneficiary entities) or, in alternatively, in a deduction accompanied by an exemption (eg, deduction in the sphere of the paying entity and exemption in the sphere of the recipient entity).

The scope is, however, restricted to agreements between related parties, requiring a percentage of direct or indirect interests of at least 25% of the capital and / or income.

The matter associated with hybrid mechanisms related to the transfer of assets from other EU or third countries, provided for in EU Directive 2016/1164 and contained in ATAD 1 and 2, was transposed into Portuguese domestic law by Law 32/2019 of 3 / 5 namely with the amendment of several articles of the CIRC.

It should be noted that all ATAD 1 measures and almost all ATAD 2 measures were already reflected in Portuguese tax legislation, namely:

- Limitations on interest deductibility (interest capping rule)

- Exit tax – transfer of residence

- General Anti-abuse Standard

- Imputation of income from non-resident entities subject to a privileged tax regime (CFC rules)

2-DAC 6

Community standard DAC 6, referred to in Directive (EU) 2018/822 of 5/25 (which amended Directive (EU) 2011/16), transposed into Portuguese domestic law by Law 26/2020 of 7/21 , establishes the obligation on the part of tax intermediaries to declare transactions that can be considered aggressive tax planning and that occur at the international level. The information obligations set out in this regulation are aimed at tax intermediaries, that is, consultants, lawyers, managers or financial institutions, who will be required to submit the corresponding declarations to the Tax Administration, within the scope of the legal transactions or business carried out by the tax authorities. parties in two Member States of the European Union or in a Member State and a third State.

This now approved standard revoked DL 29/2008 which, in a way, already dealt with this matter

It should be noted that since this Law was enacted, a note was published on the presidency’s website referring to “doubts about the extension of the scope of the Community Directive to purely internal transactions, with the possible costs in comparison with other European legal systems that did not adopt the same orientation… “

Within the scope of the disturbances caused by Covid 19 and, as approved by Directive 2020/876, transposed by DL 53/2020 of 11/8, the application of DAC 6 was deferred in the following terms:

– the “intermediaries” and the relevant taxpayers must communicate, by February 28, 2021, the cross-border mechanisms that took place between 25 June 2018 and 30 June 2020;

– the mechanisms to be communicated carried out between 1 July 2020 and 31 December 2020 must be implemented by 31 January 2021.

– the mechanisms to be communicated carried out after 1 January 2021 must be carried out within a generic period of 30 days from the beginning of the application of the mechanism.

3 — Transfer pricing

Article 63 of the CIRC (transfer pricing) stipulates that, in relation to transactions with entities in a situation of special relations, conditions identical to those that would normally be contracted with independent entities must be contracted.

Although pursuant to paragraph 3 of article 13 of P 1446-C / 2001 companies can be exempted from having a “transfer pricing file” if they have an annual sales and other income of less than 3 million euros, companies in its commercial relations with its subsidiaries, must always safeguard special relationship situations, without which we may be faced with tax contingencies.

With the publication of Law 119/2019 of 9/18, the regime in force was amended with the amendment of the aforementioned article 63 of the CIRC.

From a declarative point of view, the mandatory submission of transfer pricing documentation to the Tax and Customs Authority (AT), within the deadline set for the submission of the IES, for taxable persons whose tax situation must be accompanied by the Major Taxpayers Unit (UGC), at the same time that fines were redefined for failure to present this documentation, which are now punishable by a fine of Euro 500 to Euro 10,000, plus 5% for each day of delay in complying with these obligations (paragraph 6 of article 117 of the RGIT).

At the same time, this Law also opens doors to the amendment of the Transfer Price Ordinance currently in force (Ordinance No. 1446-C / 2001), responding to the new international framework for transfer pricing, resulting from the OECD / G20 referring to BEPS.

With the changes imposed and also with the introduction of new declarative obligations, AT endows itself with means that, if properly used, may, on the one hand, provide a greater capacity for analysis and identification of operations that deserve appreciation, as well as, on the other hand, increase the resources available to AT to substantiate any corrections that may be imposed in terms of transfer pricing.

Thus, the conditions seem to be created for greater and more effective action by the AT in matters of transfer pricing, with the expectation of an increase in the incidence of tax inspection actions in this regard.

For taxpayers, it remains, at the moment, to make efforts to adapt to the legislative change and ensure full compliance with the new declaratory obligations in matters of transfer pricing.

4-CbC – Country By Country Report.

Following OECD recommendations under the BEPS Action Plan (action 13), Article 121-A of the IRC Code introduced the obligation of final parent entities, or replacement parent entities, into Portuguese law of multinational groups, whose total income is equal to or above 750 million euros, and in certain situations the companies constituting these groups, submit a declaration of financial and tax information by country or tax jurisdiction (“Country-by-Country Report” ).

Paragraph 4 of the aforementioned article determines that any entity, resident or with a permanent establishment in Portuguese territory, that integrates a Group in which any of the entities is subject to the presentation of the “Country-by-Country Report”, communicates electronically to reporting entity of the Group, the country or jurisdiction in which it is resident for tax purposes, its tax identification number and address.

Ordinance 367/2017 of 11/12 approved the model and the respective filling instructions, allowing the taxable person to comply with the aforementioned obligation (mod 55) which must be done for the group’s subsidiary companies by the end of the 5th month after the fiscal year end date.

Significant are the fines introduced by Law 119/2019 of 18/9, which amended paragraph 6 of article 117 of the RGIT, which states:

“Failure to provide documentation regarding the transfer pricing policy adopted, as well as failure to submit, within the legally stipulated period, the declaration declaring the identification of the declaring entity or the financial and tax declaration per country relating to entities of a multinational group, it is punishable by a fine of (euro) 500 to (euro) 10,000, plus 5% for each day of delay in fulfilling these obligations ”.

In summary, greater sensitivity and strengthening of AT control in all these matters that make up BEPS are also expected.

This communication is of a general nature and merely informative, not intended for any particular entity or situation, and does not replace professional advice appropriate to the specific case. Vitis will not be responsible for any damage or loss arising from decisions made based on the generic and synthetic information described here.

The text was prepared based on the best information available at the time of its edition